UNCTAD: War in Ukraine Disrupts Global Supply Chains

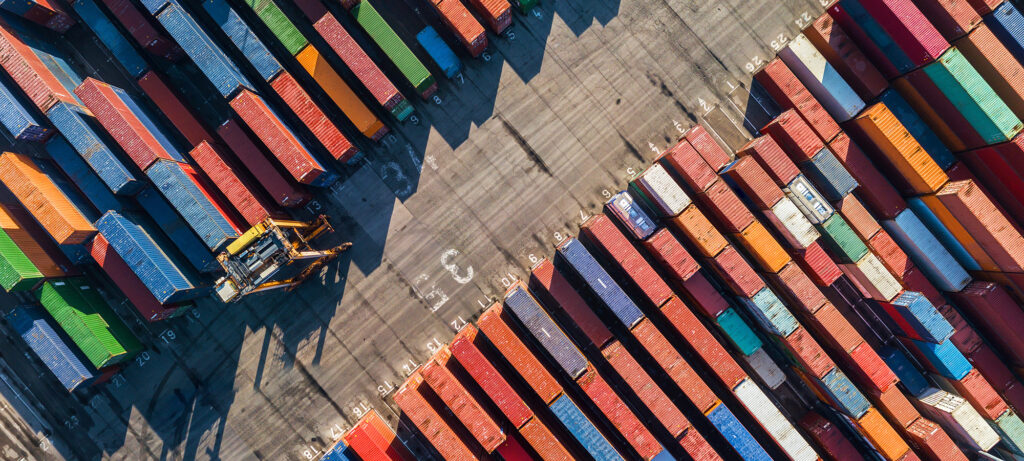

Major ports in Europe are grappling with warehousing and storage capacity crises due to Russia and Ukraine cargo pile-up, a situation that has disrupted container shipping operations and thrown global value chains into disarray, the UN Conference on Trade and Development (UNCTAD) has said. UNCTAD, in an assessment of the war in Ukraine and its effects on maritime trade logistics, reports that cargo destined for Russia and Ukraine is piling up at ports like Hamburg, Rotterdam, Constanta, and Istanbul. The disruption has left shippers facing delays and an increase in detention and demurrage charges at ports. The ripple effects have had significant pressure on warehousing and storage capacity, leading to an increase in supply chain costs, an increase in consumer prices, and an unrelenting surge of inflation across the globe. With the high container freight costs being passed on, consumer prices have increased by 1.6 percent. Global import price levels are expected to increase on average by 12 percent as a result of sustained freight rate increases. “Global trade depends on a complex system of ports and ships that connect the world. If global trade is to flow more smoothly, it must be ensured that Ukrainian ports are open to international shipping and that collaboration among transport stakeholders continues to provide services,” states UNCTAD. The report finds that the war in Ukraine is stifling trade and logistics of the country and the Black Sea region, increasing global vessel demand and the cost of shipping around the world. In effect, Ukraine’s trading partners now have to turn to other countries for the commodities they import due to disruptions in regional logistics, halting of port operations, destruction of important infrastructure, trade restrictions, increased insurance costs, and higher fuel prices. Many countries are now being forced to look further afield for suppliers of oil, gas, and grain, the consequence of which has been an increase in shipping distances along with transit times and costs. “Grains are of particular concern given the leading role of the Russian Federation and Ukraine in agrifood markets, and its nexus to food security and poverty reduction,” says the report. Russia and Ukraine account for 53 percent of global trade in sunflower oil and seeds and 27 percent of wheat. A total of 36 countries import more than 50 percent of their wheat from the two warring nations. Ukraine, which exported around 50 million tonnes of grain in 2021 and had projected a growth of three percent in global exports this year, has been forced to revise projections downward and expects exports to shrink by 3.2 percent. About 90 percent of Ukraine’s grain export capacity has been cut off by the Russian blockade of Odesa and other Black Sea ports. In addition, over the four-month period from February to May, the Baltic Dry Index increased by 59 percent, which is expected to lead to an additional increase of 3.7 percent in consumer food prices globally. Almost half of the increase is due to higher transport costs, resulting from higher freight rates and longer distances. Middle-income nations are expected to be the hardest hit. Apart from commodities, the conflict is having adverse impacts on energy with higher prices exacerbating the challenges faced by shippers. With trade restrictions and shifts in trading patterns leading to a surge in ton-mile demand, daily rates for smaller-size tankers that are key for regional oil trading in the Black Sea, Baltic Sea, and Mediterranean Sea regions, have dramatically increased. The higher energy costs have also led to higher bunker prices, raising shipping costs for all maritime transport sectors. By the end of May 2022, the global average price for very low sulfur fuel oil (VLSFO) reached over $1,000 per tonne, a 64 percent increase compared to the beginning of the year and the average fuel surcharges charged by container shipping lines have risen close to 50 percent since the beginning of the war.